Bruce, Keith and Rhum

As operator, Serica has invested in its assets and replaced reserves

Bruce, Keith & Rhum

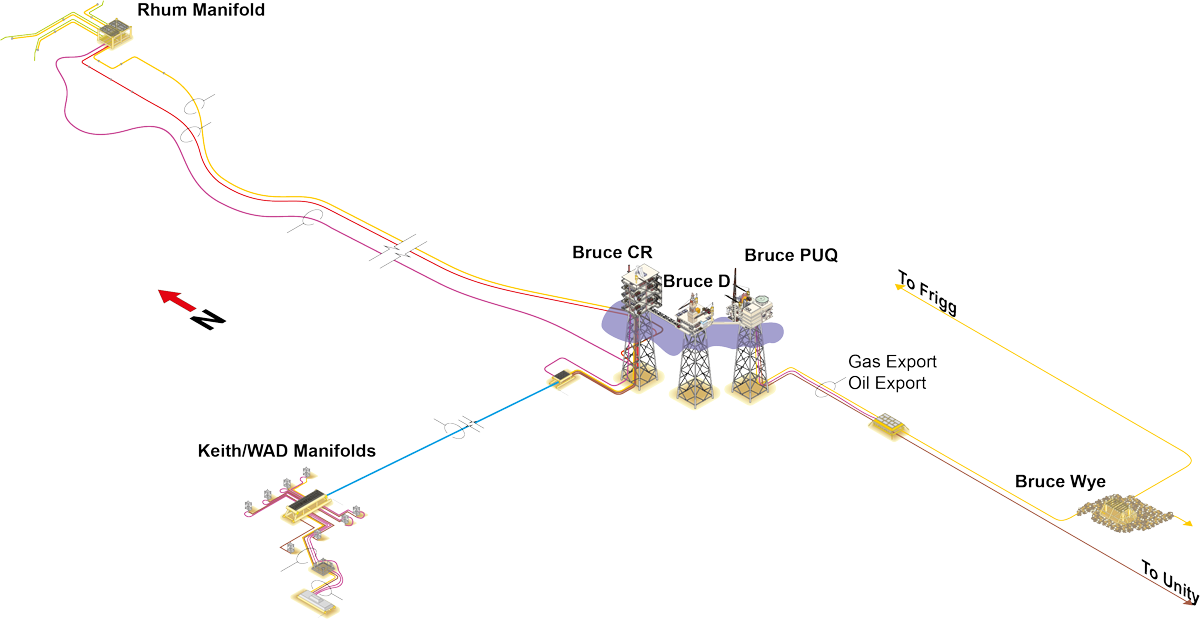

Serica is owner and operator of the Bruce (98%), Keith (100%) and Rhum (50%) assets consisting of over 25 wells, three bridge-linked platforms and extensive subsea pipelines and infrastructure that tie-in Rhum, Keith and the Western Area of Bruce to the Bruce facilities. Collectively, these assets produced an average of 16,100 boe/d in 2025, and significantly contribute to the UK gas demands.

Bruce

The Bruce field is a producing asset located in blocks 9/9a, 9/8a and 9/9b in the Northern North Sea.

- Gas exported via the Frigg pipeline to the St Fergus terminal and liquids exported via the Forties Pipeline System

- Comprised of three linked platforms:

- Production Utilities Quarters Platform with quarters for crew (max. 168 persons)

- Drilling Platform

- Compression/Reception Platform which hosts reception and compression facilities

- Combination of platform wells and Western Area Development subsea tie-back

Partners: Serica (operator) 98%, BP 1%, Total 1%

Keith

- Single well subsea tie-back to Bruce

Partners: Serica (operator) 100%

Rhum

The Rhum gas field is located in block 3/29a, 44km north of Bruce and is a subsea development tied back to the Bruce platform via an insulated pipeline. Rhum is a strategic UK gas asset with significant upside potential.

- Three subsea producing wells, R1, R2 and R3. Rhum changes to the subsea pipeline system were carried out around the end of 2024, which should increase reliability

- High quality reservoir displaying ‘tank’ characteristics

- High pressure, high temperature reservoir

Iran Oil Company (U.K.) Limited (‘IOC’) has held a non-operated 50% interest in the Rhum field since its discovery in 1977. In November 2018, 100% of the shares in IOC were assigned from Naftiran Intertrade Co. (NICO) Limited - part of the National Iranian Oil company group - to a Jersey purpose trust. At the same time, management of IOC’s interest in the Rhum field was delegated to Rhum Management Company Limited (‘RMC’), formed for this purpose and also wholly owned by the Jersey trust. As a result of these arrangements, neither NICO nor any other Iranian entity currently has any ownership, financial benefit or involvement in the Rhum field. RMC acts effectively as Serica’s joint venture partner in Rhum.

Following the U.S. withdrawal from the Joint Comprehensive Plan of Action, these arrangements in relation to IOC and its interest in the Rhum field were a condition of the Office of Foreign Asset Control (OFAC) – part of the U.S Treasury Department – continuing to issue an OFAC License.

The OFAC License permits the supply of specified goods and services to the Rhum field from certain U.S. and U.S. owned or controlled companies. In addition, OFAC has provided a written assurance that all other companies that are neither U.S. companies nor U.S. owned or controlled can provide goods and services to the Rhum field without being exposed to breach of U.S. secondary sanctions.

Subsequently, the OFAC License and secondary sanctions assurance have been periodically renewed without interruption. The current OFAC License and secondary sanctions assurance run to 28 February 2027.

Partners: Serica (operator) 50%, IOC (UK) Limited 50%